COVID-19 JobKeeper Payment Summary

The Government is introducing a subsidy program to support employees and businesses. This measure was announced on 30th March, 2020 and is yet to be legislated. There will be more information made available including clarification regarding reporting requirements. We urge everyone to follow us on Facebook for further updates and announcements as they come. Here is our summary of the Job keeper subsidy program.

The Benefit:

The Government will provide $1,500 per fortnight per eligible employee for up to 6 months.

Who is eligible to receive the benefit:

Employers (including non-for-profits) and self- employed individuals (businesses without employees) will be eligible for the subsidy if you meet the following conditions:

your business has a turnover (sales) of less than $1 billion and your turnover will be reduced by more than 30%; or

your business has a turnover of $1 billion or more and your turnover will be reduced by more than 50%; and

your business is not subject to the Major Bank Levy.

To establish that your business has had a reduction in turnover to meet the eligibility requirements above, you would need to establish that:

your turnover has reduced relative to your turnover in the previous year. The nature in which you lodge your activity statement i.e. monthly or quarterly and cash or accruals, will be used in determining this.

Where your business was not operating in the previous year, or where your turnover in the previous year was not representative of your usual or average turnover, (e.g. because there was a large interim acquisition, you were newly established or your turnover is typically highly variable), the Tax Commissioner will have discretion to consider additional information that the business can provide to establish that they have been adversely affected by the impacts of the Coronavirus.

The Tax Commissioner will also have discretion to set out alternative tests that would establish eligibility in specific circumstances (e.g. eligibility may be established as soon as a business ceases or significantly reduces its operations).

There will be some tolerance where employers, in good faith, estimate a greater than 30% fall in turnover but you actually experience a slightly smaller fall.

Employer/employee relationship eligibility requirements:

Employees currently employed by your business (including those stood down or re-hired);

The employees were employed by your business at 1 March, 2020 including:

full-time and part-time employees; and

casual employees that have been employed on a regular basis for longer than 12 months as at 1 March, 2020.

The employees are at least 16 years of age;

The employees are not in receipt of a JobKeeper Payment from another employer;

Your employee must also be:

an Australian citizen; or

the holder of a permanent visa; or

a Special Category (Subclass 444) Visa Holder.

Employees that are re-engaged by a business that was their employer on 1 March, 2020 will also be eligible.

Self-employed eligibility requirements

Self-employed individuals will also be eligible to receive the JobKeeper Payment where you have suffered or expect to suffer a 30% decline in turnover relative to a comparable period a year ago (of at least a month).

How do receive the benefit

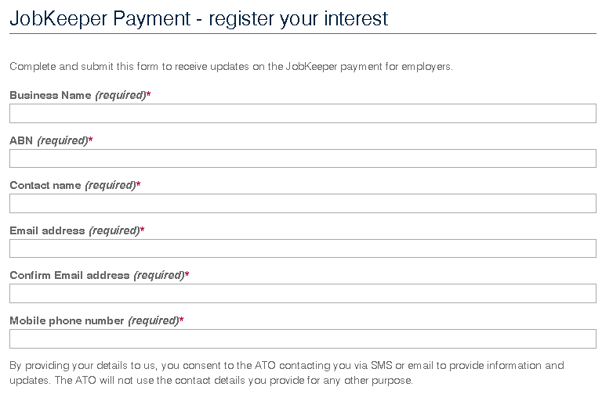

Your business must register an intention to apply for the JobKeeper Payment via: https://www.ato.gov.au/general/gen/JobKeeper-payment/ and complete the following details:

You should register an intention to apply if you believe you have or are likely to experience the required turnover decline.

Please note on registering your interest, you are not registered and no further information is available on when you will be registered and able to provide the additional information. It is important to register your interest to ensure you can register once further information is available.

Once registered you will need to:

provide supporting information demonstrating a downturn in your business; and

the number of eligible employees employed by the business on a monthly basis including:

information on the number of eligible employees engaged as at 1 March 2020; and

those currently employed by the business (including those stood down or rehired).

Self-employed businesses will need to:

provide your businesses ABN;

nominate an individual to receive the payment;

provide the Tax File Number of the individual nominated; and

provide a declaration as to recent business activity.

Provide monthly updates to the ATO to declare your continued eligibility for the payments.

When do you receive the benefit:

Payments will be made to the employer monthly in arrears by the ATO on meeting the registration and eligibility requirements.

The subsidy will start on 30 March, 2020, with the first payments to be received by employers in the first week of May.

What are your obligations if you receive the JobKeeper Payment:

For Employers:

Provide information to the ATO on eligible employees.

Ensure that each eligible employee receives at least $1,500 per fortnight (before tax).

For employees that were already receiving $1,500 per fortnight (before tax), then their income will not change.

For employees that have been receiving less than $1,500 per fortnight (before tax), you will will need to top up the payment to the employee to $1,500, before tax.

For employees earning more than $1,500 per fortnight (before tax) you are able to provide them with a top-up.

Notify all eligible employees that you are receiving the JobKeeper Payment.

Participating employers will be required to ensure eligible employees will receive, at a minimum, $1,500 per fortnight, before tax.

For Self-Employed:

People who are self-employed will need to provide a monthly update to the ATO to declare their continued eligibility for the payments. Payment will be made monthly to the individual’s bank account.

WARNING – your business is only required to pay superannuation on the portion of wages paid above the $1,500 JobKeeper Payment per fortnight to your employees, however you may choose to pay superannuation on the full amount.

What do you need from your employee:

Employees that have multiple employers must notify you that you are their primary employer (the employee claiming the tax free threshold will in most cases be sufficient notification that an you are their primary employer).

Employees that are not Australian citizens must notify you of their visa status, to allow you to determine if they are an eligible employee.

WARNING - for employees and self-employed

Where an employee or self-employed individual is accessing support through Services Australia because they have been stood down, had their hours or turnover reduced and the employer or self-employed will be eligible for the JobKeeper Payment, they should advise Services Australia of their change in circumstances online at my.gov.au or by telephone.

Please contact our office on 8523 0999 if you need further clarification on this information.

We would like to remind you that we are here to help you and will continue to be throughout this challenging time.

Stay safe and look after each other.

Sources: https://treasury.gov.au/coronavirus/jobkeeper

Regards,

The Team at Milanese & Co Accountants