MAY 2024 FEDERAL BUDGET OVERVIEW

On Tuesday 14th May 2024, Jim Chalmers handed down the 2024/2025 budget which consisted of several tax changes. Overall, there were very few surprises announced that will impact small businesses and individual taxpayers that had not previously been announced.

We have highlighted the areas below that we feel will be most valuable to you. Please note, until legislated these Federal Budget announcements are only proposed changes unless noted otherwise.

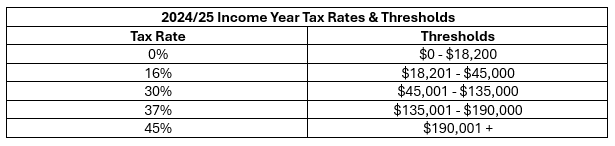

2024/25 Income Year Tax Rates & Threshold Changes

The revised stage three personal tax cuts were announced again. This includes changes to marginal income tax rates and thresholds for both resident and foreign resident individuals from 1st July 2024 (2025 Financial Year & onwards). This measure has been passed through parliament.

Medicare Levy Low-Income Thresholds

Increased Medicare levy low-income thresholds will be implemented from 1st July 2023, raising the threshold at which no Medicare levy is payable for the following:

For non-senior individuals to $26,000 ($26,000 - $32,500 at a reduced rate);

For families eligible for the seniors and pensioners tax offset to $41,089 ($41,090 - $51,361at a reduced rate);

For senior individuals to $57,198 ($57,199 - $71,497 at a reduced rate); and

For families not eligible for the senior and pensioners tax offset to $43,846 ($43,847 - $54,807 at a reduced rate).

This measure has been passed through parliament.

Instant Asset Write-Off Thresholds

The instant asset write-off threshold for small businesses is to apply to business assets less than $20,000 purchased, first used, or installed ready for use by 30th June 2025. This applies to businesses with an aggregated annual turnover of less than $10 million. It is proposed the instant asset write off will be reduced from 1st July 2025 to assets less than $1,000.

Attention on BAS Refunds

The ATO has strengthened its approach in combatting fraud associated with lodged BAS’. The time to notify a taxpayer if it intends to retain a BAS refund for investigation has been extended from 14 days to 30 days. This measure will be proposed to take effect from the first financial year after it is passed through parliament.

Energy Bill Relief

Energy bill relief initiatives include rebates and support for small businesses, such as the Energy Bill Relief Fund which will provide energy bill relief of $325 to eligible small businesses.

Digital ID System & Cybersecurity

To bolster cybersecurity and facilitate digital transformation, the government is expanding the Digital ID System. This expansion aims to reduce the administrative burden on small businesses by minimizing the amount of ID data they need to store and protect for customers and employees. Additionally, the government will be funding initiatives like the Cyber Wardens program and the Small Business Cyber Resilience Service will provide training and support to enhance online security measures.

Foreign Resident Tax Changes

The government aims to strengthen the foreign resident Capital Gains Tax (CGT) regime to ensure equitable taxation and improve compliance. Effective from 1st July 2025, amendments will:

Clarify and expand the types of assets subject to CGT for foreign residents.

Modify the point-in-time principal asset test to a 365-day testing period.

Require foreign residents selling shares and membership interests exceeding $20 million in value to notify the ATO before the transaction.

These changes seek to align the tax treatment of foreign residents with that of Australian residents, ensuring fair taxation on assets with a close economic connection to Australian land.

Superannuation Reforms

The budget introduces significant reforms to superannuation, including:

Superannuation payments on Commonwealth government-funded Paid Parental Leave will commence from 1st July 2025. Eligible parents will receive an additional contribution to their superannuation fund based on the Superannuation Guarantee.

The Fair Entitlements Guarantee Recovery Program will be recalibrated from 1st July 2024, to pursue unpaid superannuation entitlements owed by employers in liquidation or bankruptcy.

Other Budget Measures

Several additional measures have been announced, including:

Granting the Commissioner of Taxation discretion to not offset refunds against old tax debts.

Extension of various ATO compliance programs, such as the Personal Income Tax Compliance Program, the Shadow Economy Compliance Program, and the Tax Avoidance Taskforce.

Expansion of the scope of Part IVA of the ITAA 1936, focusing on schemes reducing tax paid in Australia and those achieving an Australian income tax benefit.

Withdrawal of the anti-avoidance rule denying deductions for payments made to related parties in low or no-tax jurisdictions.

Introduction of a penalty for taxpayers as part of a group with over $1 billion in global turnover mischaracterising or undervaluing royalty payments.

Continuation of freezing social security deeming rates until 30th June 2025, to support age pensioners and income support recipients.

Reforms to Australia's tertiary education system, including changes to debt indexation and the establishment of a ‘Commonwealth Prac Payment’ for students undertaking mandatory placements.

Additionally, the government will provide direct energy bill relief of $300 to every Australian household from 1st July 2024, to alleviate cost-of-living pressures. As always, if you have any questions about any of the above, please don't hesitate to contact our office to discuss on 08 8523 0999 (Gawler Office), 08 8299 9444 (Northgate Office) or admin@milaneseco.com.au.